When buying shares in a company, it’s important to keep in mind the possibility that it could fail, and you could lose your money. But on the bright side, you can make more than 100% with a really good stock. Another great example is Accton Technology Corporation (TWSE:2345) which has seen its share price rise 233% over five years. Last week the share price rose by 3.6%.

Since it’s been a strong week for Accton Technology shareholders, let’s take a look at the long-term fundamentals trend.

Check out our latest review for Accton Technology

In his essay Graham-and-Doddsville Superintendents Warren Buffett explained how share prices do not always reflect the value of a business. Another imperfect but easy way to think about how a company’s market sentiment has changed is to compare the change in earnings per share (EPS) to the company’s share price.

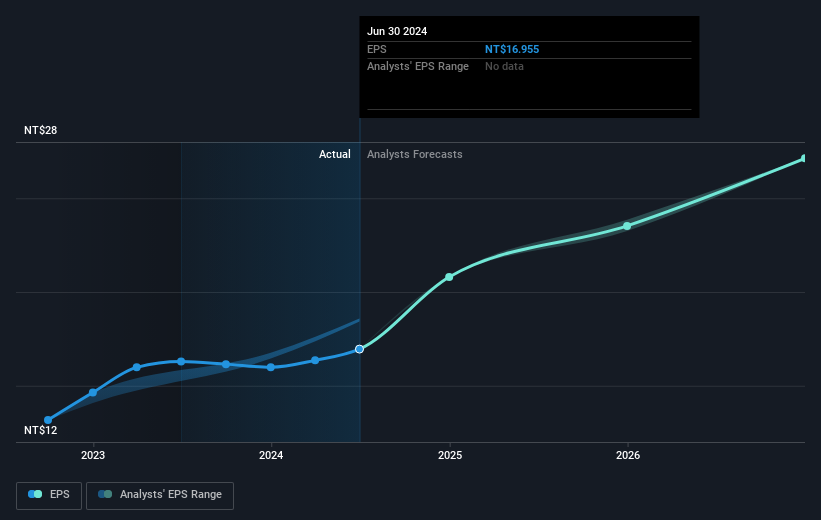

During five years of share price growth, Accton Technology has achieved consolidated earnings per share (EPS) growth of 20% per year. This EPS growth is slower than the share price growth of 27% per year, over the same period. So it’s fair to assume that the market has a higher opinion of the business than it did five years ago. That’s not surprising given the five-year record of earnings growth.

Each company’s earnings (over time) are shown in the chart below (click to see the exact numbers).

This for free The interactive report on Accton Technology’s earnings, revenue and cash flow is a good place to start, if you want to investigate the stock further.

What About Deficiencies?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price refund. While the return on share price only shows the change in share price, TSR includes the value of dividends (assumed to have been reinvested) and the benefits of any capital increase or decrease. It’s fair to say that TSR provides a more complete picture for dividend-paying stocks. As it happens, Accton Technology’s TSR for the past 5 years was 271%, which exceeds the share price return mentioned earlier. And there is no prize for guessing that the dividend payments explain the difference!

A Different View

Accton Technology has delivered a TSR of 20% over the past twelve months. But that was short of the market average. On the bright side, long-term returns (running around 30% per year, over half a decade) look better. It may be that this is a business worth watching, given the continued positive reception, over time, from the market. Before you form an opinion on Accton Technology you may want to consider these 3 quality metrics.

Of course, you can find a good investment by looking elsewhere. So check this out for free a list of companies we expect to grow earnings.

Please note, the market capitalizations quoted in this article reflect the estimated market capitalization of stocks currently traded on the Taiwan exchange.

New: Manage all your stock portfolios in one place

We made the ultimate portfolio partner for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Alerting of New Warning Signs or Hazards by email or phone

• Track the Quality of your goods

Try Demo Portfolio for free

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide opinions based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not include recent company announcements that are not sensitive to pricing or quality equipment. Simply Wall St has no position in the stocks mentioned.

#Accton #Technology #TWSE2345 #stock #outperforming #earnings #growth #years